When you acquire an asset for your business, you often want the added advantage of writing off the purchase as an expense, to avoid paying taxes on the asset that year. However, there are IRS rules that dictate which assets can be fully expensed and which ones must be depreciated over a period of time, often referred to as “useful life”. If your goal is to speed up the depreciation of your assets in order to capture that tax reduction more quickly, there are some ways that could be accomplished.

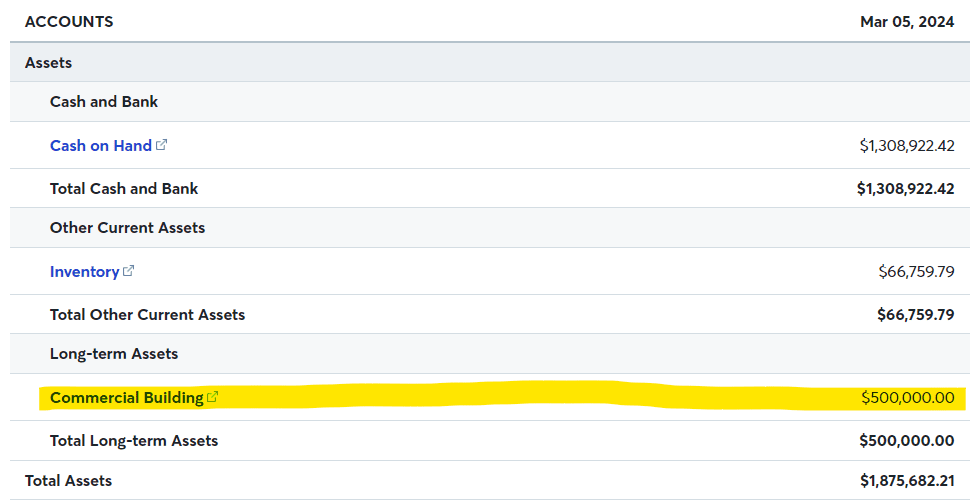

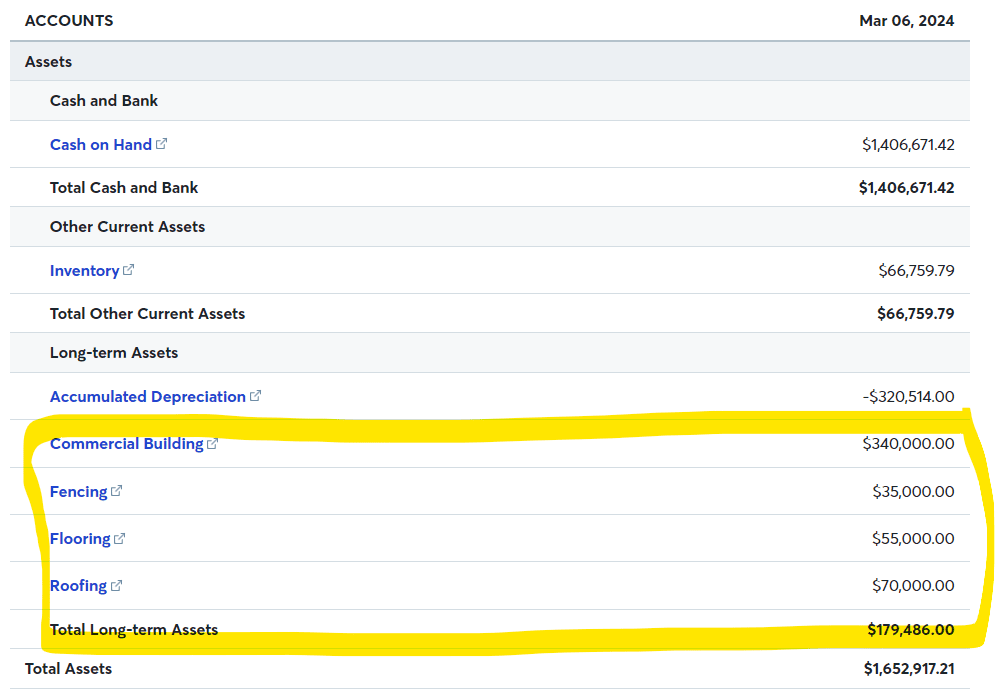

From the perspective of bookkeeping, tracking and understanding depreciation is fairly simple. When you purchase a long-term asset it gets added to your balance sheet, adding value to the company. The corresponding expense, either taken immediately or over time goes to the account you used to purchase it. It may look a little bit like the example below.

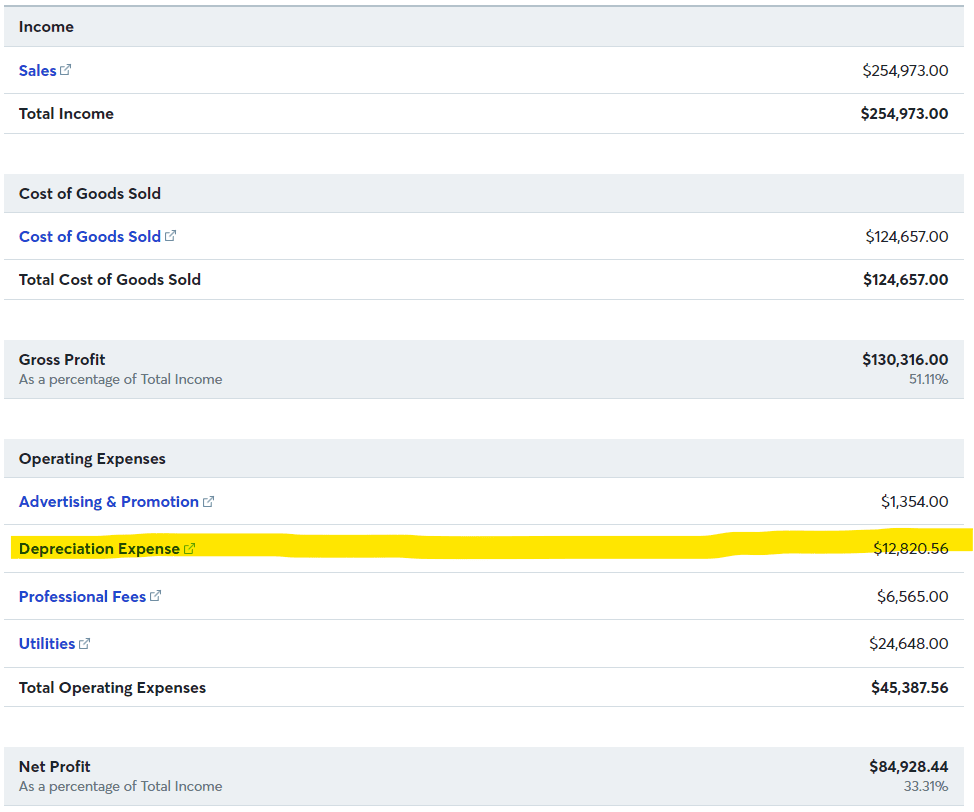

Excellent, now you can see the book value of your asset when looking at your Balance Sheet. In the example above, the “useful life” for commercial buildings is 39 years. This means that you will take the price paid for the building, $500,000, and depreciate it by $1,068.38 each month. This depreciation is added to a Profit & Loss report line item generally referred to as “Depreciation Expense”. It is this business expense that reduces your business taxable income for the year. With each month of depreciation, the depreciated amount is also added to a line in the Balance Sheet called “accumulated depreciation” which tracks how much that asset has been reduced so far (this is important later). In a full year, you would expect to see about $12,820.56 in depreciation expense for that building. Note that $12,820.56 is a long way off from the $500,000 in cash or loans you already spent in order to build the asset. You can see below what this expense would look like in your year end P&L using the details discussed above. It is important to point out that what book depreciation often does not match the depreciation listed on your tax return. One reason for this is that when you bonus depreciate an asset on your tax return, you may not want to depreciate it off your books, as you still own that asset and it does still have value.

These examples show what depreciation could look like and hopefully helps to show how useful life affects the rate at which you can utilize the depreciation expense in order to reduce your taxes. Now we will talk about why or why not a business might want to increase the rate at which some assets are being depreciated.

Depreciating an asset if they want to recognize a higher amount of expenses in the short term to counter higher net profits. Imagine that your business has just landed a large government contract that is secured for the next 5 years. In order to best serve the client, you need to make a large addition to your office. With the new income over the next 5 years, it may be nice to get a larger portion of the potential depreciation expense accelerated faster than 39 years. This may be a good time to try and find ways to increase the depreciation of your assets.

No, commercial property is not eligible for bonus depreciation.

No, land is not considered to have a “useful life” and can not be depreciated

No, there are many assets that you are required to depreciate in the US.

You can amend tax returns from up to 3 years ago.

Let’s say that you are just starting your business, and you expect to post a loss for the next couple of years as the gears warm up. By allowing your newly acquired assets to depreciate over their full useful life, you can leverage that expense in years when you have more revenue you are seeking to cover. If you depreciate it all in year 1, you have nothing left to depreciation when the profits start to add up. In addition, you can not bonus depreciate your business into a net loss. If you are already in the red, additional depreciation does not provide any tax benefit and instead just reduces your available depreciation for future years.

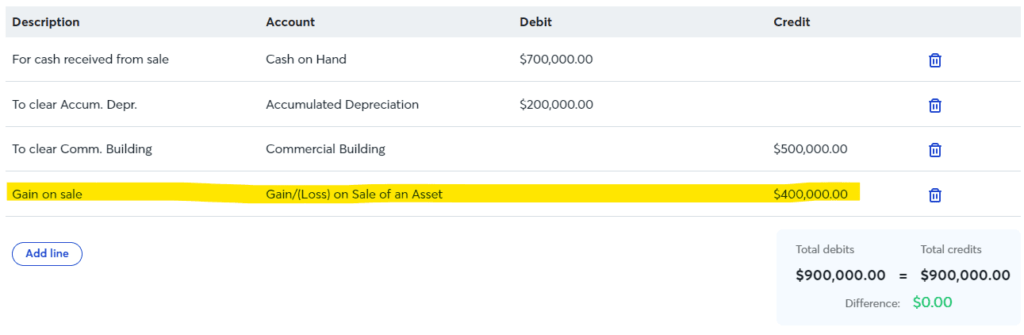

There is another key with depreciation, and it links back to that Balance Sheet line I mentioned earlier called “Accumulated Depreciation”. Accumulated depreciation comes in to play when selling an asset, as it sets the remaining value of the asset in question. Let’s go back to our example of the $500,000 commercial building above. Let’s assume that after a number of years you decide to sell the building. Since it was completed, the balance sheet shows that it has $200,000 in accumulated depreciation, resulting in a remaining value of $300,000. You may think that if you sell the building for $700,000, you have a gain of $200,000 (Sale Price – Initial Cost = Gain) and will pay capital gains on that amount. You would be incorrect! On the books, your gain or loss is determined not by the initial price of the asset, but the remaining value of the asset after accumulated depreciation. Your gain would therefor be $400,000 (Sales Price – Remaining Value), and that is the number you would be expected to pay capital gains on. See the example below to help you visualize this transaction. *Note – for tax purposes, you would take your tax depreciation into account, not your book depreciation, so the numbers may be different on your tax return than they are on your balance sheet.

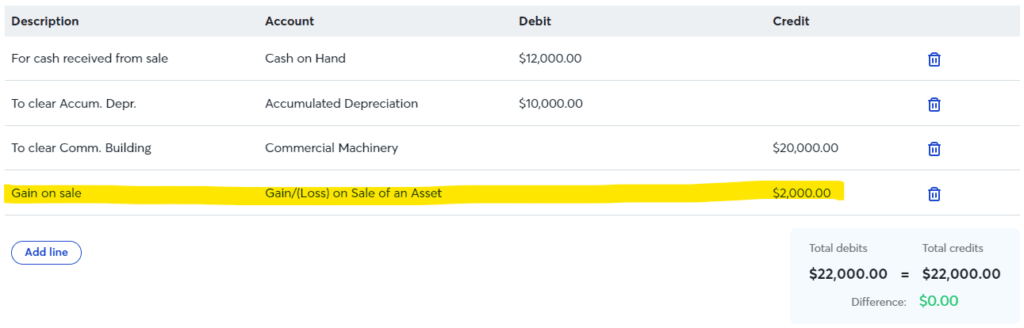

As you can see, by depreciating an asset and capturing the expense, you then have to *subtract* that expense if sold. For assets that appreciate in value, this can be excruciating. For assets that you plan to throw out or will be depleted in value, this may not be a big deal. Let’s look at an example of an asset that decreases in value over time. Imagine you purchased a large piece of commercial machinery for $20,000 a number of years ago. You decide to close down your business and are selling the equipment. On the Balance Sheet, you can see $10,000 of accumulated depreciation. If you were to sell the equipment for $12,000, you will have made a $2,000 gain (despite selling it for less than you paid for it) and will be taxed on a $2,000 capital gain. See the below example.

On the tax side, assets depreciation schedule is determined primarily by it’s “useful life”. However it is important to remember that you may depreciate at a different rate on your actual books. Only the tax depreciation will affect your taxes owed. You can look up the useful life status of assets easily online. As an example, vehicles are considered to have a useful life of 8 years and so would be depreciated over 8 years. In 2017, in order to stimulate business spending on new assets, an option referred to as “bonus depreciation” was updated in order to allow businesses to take 100% of the assets value as depreciation in the first year so long as it fits at least one of the following criteria: useful life is <20 years, it is a qualified improvement property, it is computer software, cost of qualified film, TV, or theater productions, or some properties used for both business and personal use.

Some assets, like commercial buildings, can have their depreciation sped up using a method called “cost segregation”. In cost segregation some different elements of the commercial building can be split out, such as land improvements, fixtures, or flooring, and depreciated separately than the rest of the building. Through cost segregation, you can collect more depreciation on the front end of the buildings components useful life, giving you a more immediate tax benefit.

The decision to increase the rate you recognize depreciation on an asset depends on many factors, not least of which is your overall intent and financial strategy. In order to ensure you are making appropriate and beneficial decisions, you should consult with your accountant. Here at Vertices, we help lead our clients through these questions by measuring the potential value of taking bonus depreciation or using cost segregation, and weighing it against the goals of the business shareholders.