Schedule I Controlled Substances

Substances in this schedule have no currently accepted medical use in the United States, a lack of accepted safety for use under medical supervision, and a high potential for abuse.

Some examples of substances listed in Schedule I are: heroin, lysergic acid diethylamide (LSD), marijuana (cannabis), peyote, methaqualone, and 3,4-methylenedioxymethamphetamine (Ecstasy). (from https://www.deadiversion.usdoj.gov/schedules/ )

Prior to the state legalization of Marijuana, 280E was not an IRS rule many were familiar with! IRS 280E specifically deals with taxpayers who sell Schedule I or II drugs as a business and states:

No deduction or credit shall be allowed for any amount paid or incurred during the taxable year in carrying on any trade or business if such trade or business (or the activities which comprise such trade or business) consists of trafficking in controlled substances (within the meaning of schedule I and II of the Controlled Substances Act) which is prohibited by Federal law or the law of any State in which such trade or business is conducted. (McElroy, “Taxpayers Trafficking in a Schedule I or Schedule II Controlled Substance — Capitalization of Inventoriable Costs”, 2015)

State Designations

A Sole Proprietorship is one individual or married couple in business alone. Sole proprietorships are the most common form of business structure. This type of business is simple to form and operate, and may enjoy greater flexibility of management and fewer legal controls. However, the business owner is personally liable for all debts incurred by the business.

A General Partnership is composed of two or more persons (usually not a married couple) who agree to contribute money, labor, and/or skill to a business. Each partner shares the profits, losses, and management of the business, and each partner is personally and equally liable for debts of the partnership. Formal terms of the partnership are usually contained in a written partnership agreement.

A Limited Partnership* is composed of one or more general partners and one or more limited partners. The general partners manage the business and share full in its profits and losses. Limited partners share in the profits of the business, but their losses are limited to the extent of their investment. Limited partners are usually not involved in the day-to-day operations of the business.

A Limited Liability Partnership* is similar to a General Partnership except that normally a partner does not have personal liability for the negligence of another partner. This business structure is used most commonly by professionals such as accountants and lawyers.

A Corporation* is a more complex business structure. As a chartered legal entity, a corporation has certain rights, privileges, and liabilities beyond those of an individual. Doing business as a corporation may yield tax or financial benefits, but these can be offset by other considerations, such as increased licensing fees or decreased personal control. Corporations may be formed for profit or nonprofit purposes.

The Limited Liability Company (LLC)* and the Limited Liability Partnership (LLP)* are the newest forms of business structure in Oklahoma. An LLC or LLP is formed by one or more individuals or entities through a special written agreement. The agreement details the organization of the LLC or LLP, including: provisions for management, assignability of interests, and distribution of profits or losses. Limited liability companies and limited liability partnerships are permitted to engage in any lawful, for profit business or activity other than banking or insurance.

*Registers with the Secretary of State (as listed on https://www.sos.ok.gov/corp/organization.aspx)

IRS (Federal) Designations

The breaking point in the cases that have gone to trial have largely come down to poor record keeping. In business (ESPECIALLY TO THE IRS), if it is not documented, it did not happen!

Petitioner essentially reads our Opinion in CHAMP to hold that a medical marijuana dispensary that allows its customers to consume medical marijuana on its premises with similarly situated individuals is a caregiver if the dispensary also provides the customers with incidental activities, consultation or advice. Such a reading is wrong. Petitioner also has not established that the Vapor Room’s activities or services independent of the dispensing of medical marijuana were extensive. We perceive his claim now that the Vapor Room actually consists of two businesses as simply an after-the-fact attempt to artificially equate the Vapor Room with the medical marijuana dispensary in CHAMP so as to avoid the disallowance of all of the Vapor Room’s expenses under section 280E. We conclude that section 280E applies to preclude petitioner from deducting any of the Vapor Room’s claimed expenses. (Nitti, 2018)

An excerpt from an article in Forbes:

Recordkeeping, recordkeeping, recordkeeping. This should go without saying, but if you work in an industry in which the IRS has a tool at its disposal to deny ALL OF YOUR NON-COGS DEDUCTIONS, you had better be meticulous in your record keeping. As we discussed above, if you’ve got a (substantial) second line of business, treat it like one, separately recording revenue and expenses. But even if you don’t, you HAVE to maintain consistent, thorough, and defensible allocations of costs between G&A expenses (that are subject to Section 280E) and COGS (which are not). To argue that you have half-a-million in COGS without bothering to record opening or ending inventory is to set yourself up for a quick defeat. (Nitti, 2018)

Vertically Integrated Cannabis Businesses (those who own Grow and Dispensary, Grow and Processing, or Grow, Processing, and Dispensary) have some advantages over simply owning a dispensary (as will be discussed later).

However, in keeping with good record keeping, these companies need to invest the time (or money, if you would like to outsource it) to write good job descriptions. It will not be sufficient to say, “I have a person who works the dispensary, so I pay them for that. Also, they work in processing, so I pay them for that as well.” The IRS may well deem all the salary costs to the Dispensary, where labor IS NOT a part of Cost of Goods, therefore, not reducing the revenue of the dispensary.

Job descriptions as well as documented work hours, by job or process, will be of huge benefit during an audit.

OpEx Expenses

There are two broad categories of expense for most businesses. Operation Expenses (rent, utilities, payroll, insurance, etc). Operation Expenses are expenses incurred during the operation of the business. They are specifically not part of a Cost of Goods Sold expense because they do not contribute to the making of or purchasing of inventory.

Cost of Goods Sold

Cost of Goods Sold are expenses directly related to the producing of or purchasing of inventory. For dispensaries, only the cost of the product plus any shipping necessary to get the product to the dispensary can be allocated as Cost of Goods purchases.

Why it Matters

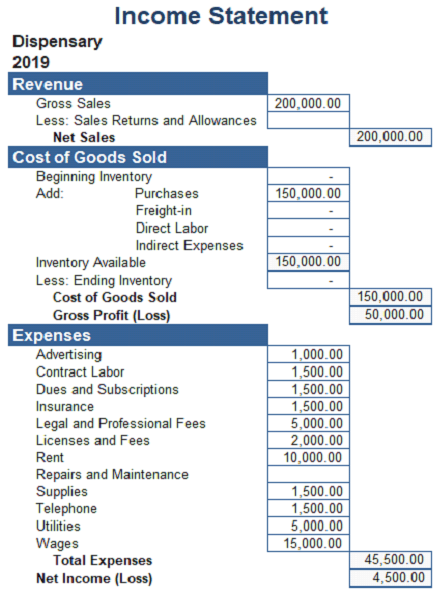

If accounting is lackadaisical, it may lead to costly ramifications. In the following example, we will look at the difference in properly allocating inventory purchases to Cost of Goods Sold vs OpEx.

Table%203

Not properly categorizing COGS results in tax paid on $200,000, instead of $50,000!!!

Proper accounting is the gateway to proper taxation. Tax preparers utilize accounting to determine taxable income. Tax preparers are charged with assimilating data into a properly filed tax return, based on the information given them.

If COGS are incorrect from accounting, they will be incorrect on the Tax Return. For cannabis, accounting, simply stated, is a service you cannot afford to be without.

Knowing what items are allowed to be part of COGS for dispensaries is THE major hurdle to having proper and accurate accounting.

Only inventory purchases and shipping for inventory to your dispensary are allowed as COGS items for Dispensaries. Items not allowed under COGS for Dispensaries:

Rent

Salaries

Contract Labor

Storage

Display Cases

Utilities

Insurance

Professional Fees

Licenses and Fees

www.deadiversion.usdoj.gov/schedules/.

Bloomenthal, Andrew. How Operating Expenses and Cost of Goods Sold Differ? 13 Apr. 2020, www.investopedia.com/ask/answers/101314/what-are-differences-between-operating-expenses-and-cost-goods-sold-cogs.asp.

Choosing the Structure of Your Business or Organization. www.sos.ok.gov/corp/organization.aspx. Oklahoma Secretary of State Website

Cost of Goods Sold for Marijuana Companies. 5 Aug. 2016, www.californiacannabiscpa.com/blog/cost-of-goods-sold-adjustments-for-marijuana-related-companies.

FindLaw’s United States Ninth Circuit Case and Opinions. 9 June 2015, caselaw.findlaw.com/us-9th-circuit/1707249.html.

Fishman, Stephen. Can Medical Marijuana Dispensaries Deduct Their Business Expenses? 31 Oct. 2014, www.nolo.com/legal-encyclopedia/can-medical-marijuana-dispensaries-deduct-their-business-expenses.html.

Fortenberry, Jeramie. Double Taxation vs Pass-Through… 24 June 2019, www.fortenberrylaw.com/double-taxation/.

Hecht, Peter. Medical Marijuana Dispensary Takes on IRS over What It Calls ‘Punitive’ Taxes. 23 Feb. 2014, www.washingtonpost.com/politics/medical-marijuana-dispensary-takes-on-irs-over-what-it-calls-punitive-taxes/2014/02/23/25fa6458-9cd3-11e3-ad71-e03637a299c0_story.html.

Marijuana Business Cost of Goods Sold (“COGS”) Overview. 18 July 2016, www.californiacannabiscpa.com/blog/marijuana-business-cost-of-goods-sold-cogs-overview.

United States, Congress, McElroy, W. Thomas. “Taxpayers Trafficking in a Schedule I or Schedule II Controlled Substance — Capitalization of Inventoriable Costs.” Taxpayers Trafficking in a Schedule I or Schedule II Controlled Substance — Capitalization of Inventoriable Costs, 23 Jan. 2015. https://www.irs.gov/pub/irs-wd/201504011.pdf. Accessed 11 Apr. 2020.

Nitti, Tony. Ninth Circuit: Legal Or Not, Marijuana Facility Cannot Deduct Its Expenses. 10 July 2015, www.forbes.com/sites/anthonynitti/2015/07/10/ninth-circuit-legal-or-not-marijuana-facility-cannot-deduct-its-expenses/#3a282f481d9a.

Nitti, Tony. The Top Tax Court Cases Of 2018: It Wasn’t A Good Year For The Marijuana Industry. 17 Dec. 2018, www.forbes.com/sites/anthonynitti/2018/12/17/the-top-tax-court-cases-of-2018-it-wasnt-a-good-year-for-the-marijuana-industry/#2a03267dc55c.

Taxes & Accounting for Oklahoma Cannabis Businesses. 27 Aug. 2019, cbpok.org/taxes-accounting-for-oklahoma-cannabis-businesses/.

Zollars, Ed. Business Consisted Solely of Selling Controlled Substances, No Deductions Other Than Cost of Sales Allowed. 14 June 2018, www.currentfederaltaxdevelopments.com/blog/2018/6/14/business-consisted-solely-of-selling-controlled-substances-no-deductions-other-than-cost-of-sales-allowed.