Understanding key financial ratios is essential for assessing your business’s financial health and making informed decisions. Financial ratios provide valuable insights into various aspects of your business, from liquidity to profitability, helping you identify strengths and areas for improvement. In this post, we’ll introduce six crucial financial ratios that every business owner should know, explain how to calculate them, and discuss how they can guide your strategic planning and growth.

Financial ratios are calculations derived from your business’s financial statements that provide insights into various aspects of its financial health, such as liquidity, profitability, and efficiency. They are important because they help you make informed decisions and identify areas for improvement.

It’s advisable to calculate and review these financial ratios at least quarterly. Regular reviews help you stay informed about your business’s financial health and make timely adjustments to your strategies as needed.

Yes, financial ratios can vary significantly by industry due to differences in business models, capital structures, and operating environments. It’s important to compare your ratios to industry benchmarks to get an accurate assessment of your business’s performance.

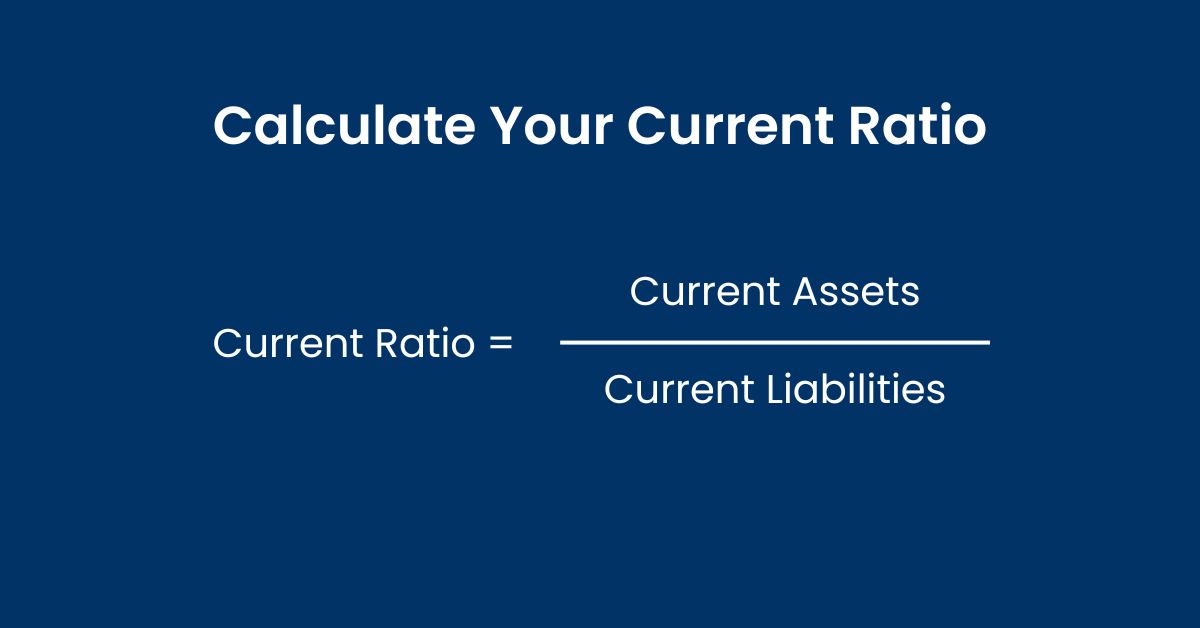

The current ratio measures your business’s ability to pay off its short-term liabilities with its short-term assets. It is a liquidity ratio that provides insight into your company’s financial stability.

A current ratio above 1 indicates that your business has more assets than liabilities, suggesting good short-term financial health. A ratio below 1 could signal potential liquidity problems, meaning your business may struggle to meet its short-term obligations.

Regularly monitoring your current ratio helps you ensure that your business maintains sufficient liquidity to cover its short-term debts, which is crucial for avoiding financial distress.

The debt-to-equity ratio compares your business’s total liabilities to its shareholders’ equity, showing the proportion of debt used to finance the company’s assets.

A higher debt-to-equity ratio indicates that your business is more heavily financed by debt than equity, which can increase financial risk. Conversely, a lower ratio suggests a more conservative approach to financing, with less reliance on debt.

This ratio helps you understand your business’s financial leverage and assess whether you’re carrying too much debt, which could be a risk in economic downturns or periods of low cash flow.

Gross profit margin measures the percentage of revenue that exceeds the cost of goods sold (COGS). It indicates how efficiently your business is producing goods and services compared to its production costs.

A higher gross profit margin indicates that your business retains a large portion of revenue after accounting for COGS, suggesting efficient production processes and pricing strategies. A lower margin may indicate higher production costs or lower pricing power.

Understanding your gross profit margin allows you to evaluate the profitability of your products or services, make pricing decisions, and identify areas where you can reduce costs.

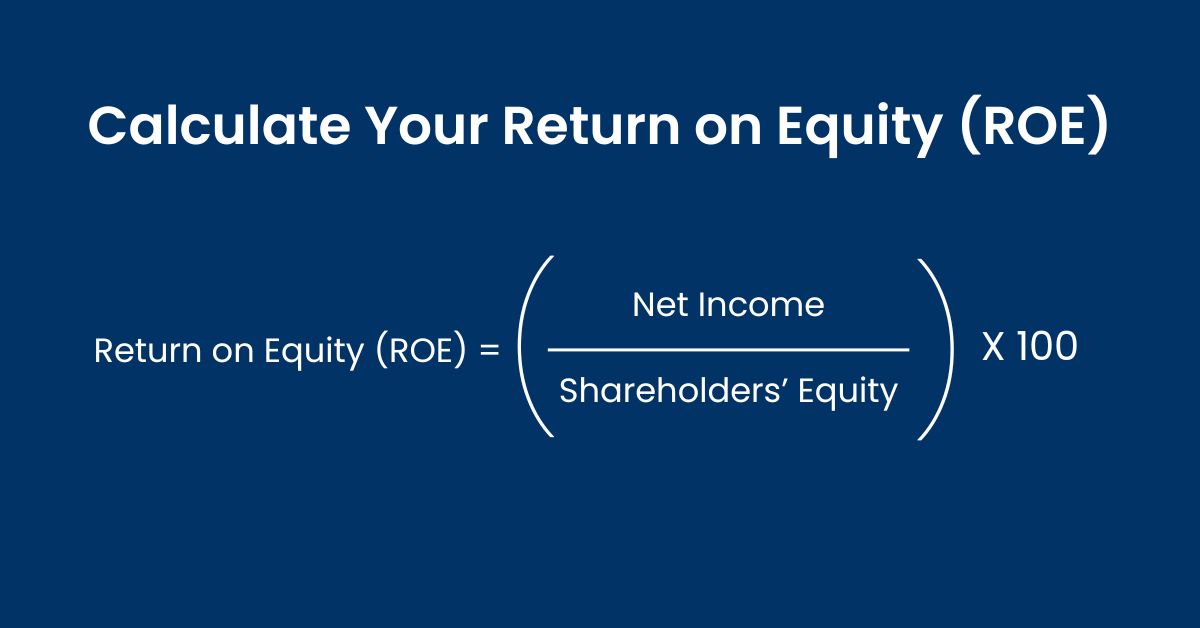

Return on Equity (ROE) measures the profitability of your business in relation to shareholders’ equity. It indicates how effectively your business is using its equity base to generate profits.

A higher ROE indicates that your business is effectively generating profits from shareholders’ equity, making it an attractive investment. A lower ROE might suggest inefficiencies or lower profitability.

ROE helps you assess the return you’re generating on shareholders’ equity, guiding decisions on reinvestment, dividends, and overall business strategy.

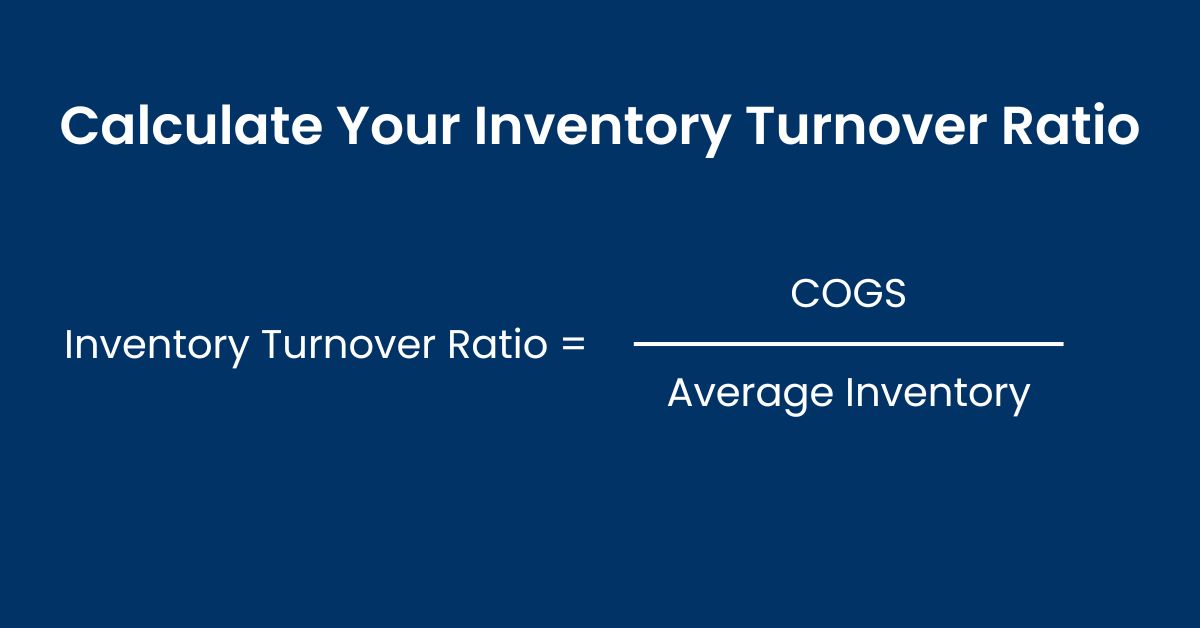

The inventory turnover ratio measures how efficiently your business manages its inventory by comparing the cost of goods sold to average inventory levels.

A higher inventory turnover ratio indicates that your business efficiently converts inventory into sales, reducing holding costs and minimizing the risk of obsolete inventory. A lower ratio may indicate overstocking or slow-moving inventory.

This ratio helps you optimize inventory levels, improve cash flow, and minimize storage costs, contributing to overall operational efficiency.

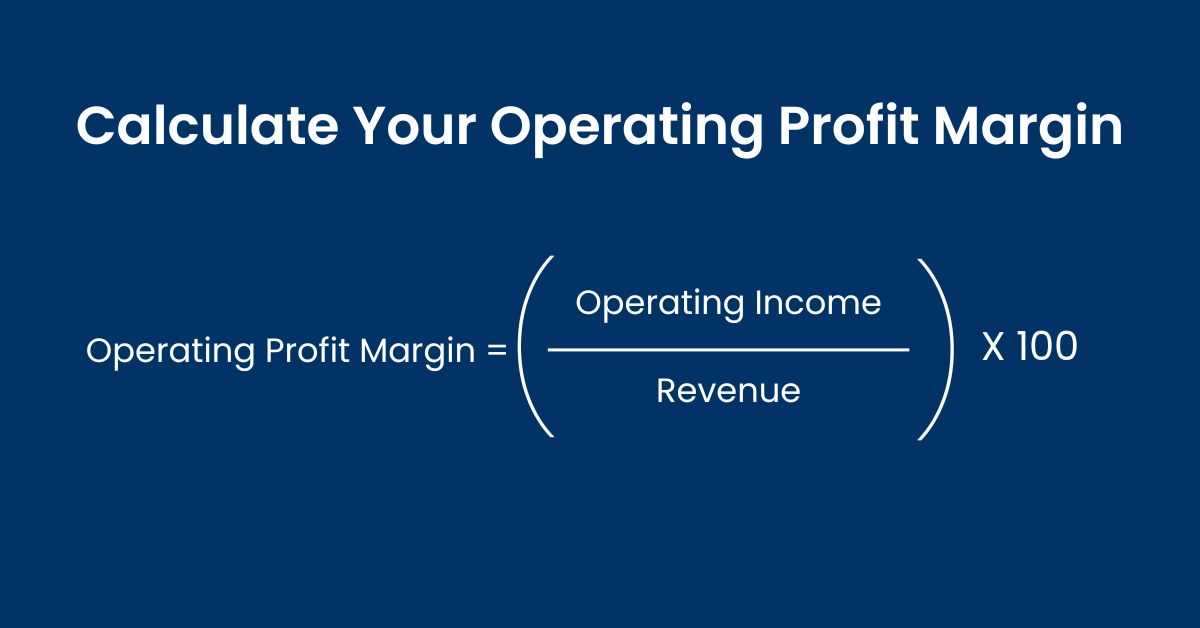

Operating profit margin measures the percentage of revenue that remains after covering operating expenses, excluding interest and taxes. It reflects your business’s ability to generate profit from core operations.

A higher operating profit margin indicates that your business efficiently controls operating costs while maintaining profitability. A lower margin may suggest inefficiencies or higher operating expenses.

Monitoring your operating profit margin helps you evaluate the efficiency of your core operations and identify areas where you can improve profitability through cost control and operational improvements.

Understanding and regularly monitoring these six financial ratios can provide valuable insights into your business’s financial health and performance. By using these ratios to guide your strategic planning and growth, you can make informed decisions that strengthen your business’s financial foundation and drive long-term success.

Need help with financial analysis? Contact Vertices today to learn more about our accounting services and how we can assist you in achieving your business goals.