Cannabis accounting has continued to confuse and frustrate business owners around the US as more states open the gates to medical and recreational cannabis sales. In February Missouri completed its first month of adult-use cannabis sales, which prompted us to look further into the specific challenges faced by Missouri cannabis companies when completing taxes and maintaining compliance.

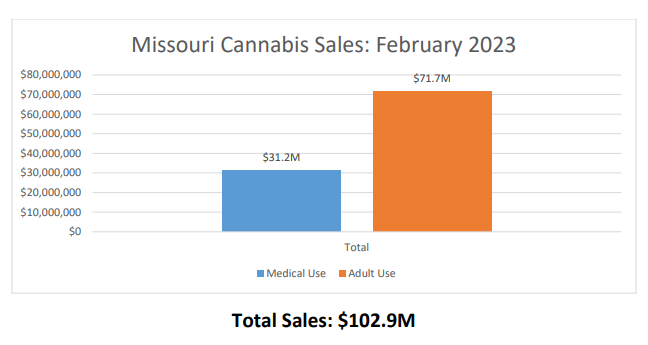

In the first month of adult-use cannabis sales in Missouri saw an impressive $71.7 million in sales. This big turnout is the top 3rd of opening months in the country of those states who have legalized recreational cannabis; being beaten only by California and Arizona. This feat is even more impressive considering sales started on the 3rd of February and there are less days in the month to have made up for the difference.

During the first month of adult-use cannabis sales Missouri saw $71.7 million for adult use and $31.2 million for medical use cannabis for a total that topped $100 million for one month. This new market is off to an impressive start, and this new revenue is sure to highlight some of the major challenges facing cannabis companies on the topic of cannabis accounting and tax.

Starting a legal cannabis dispensary in Missouri can be exciting, but also come with many challenges. One of the biggest challenges you may face as a business owner is navigating the complex taxation and accounting requirements associated with being a cannabis business.

The federal government classifies cannabis as a Schedule I drug, which means that businesses in this industry are subject to Internal Revenue Service (IRS) Code Section 280E, which disallows them from taking any deductions or credits related to their business operations. This means that many common business deductions such as advertising costs, employee compensation expenses and research and development costs are unavailable to dispensaries. This can make it difficult for dispensaries to reduce their tax burden and maximize their profits. Additionally, there are complicated local, state and federal income tax returns that must be filed accurately in order to remain compliant with the law. In the state of Missouri specifically, cannabis companies must register with the Department of Health & Senior Services before they can begin operating their business.

In addition to traditional accounting tasks such as bookkeeping and managing finances, cannabis businesses must also manage inventory tracking, payroll processing and patient data compliance. All of these requirements pose distinct financial risks that need to be handled carefully in order to keep a dispensary operating successfully. Nonetheless, due to certain restrictions defined by IRS Code 471-11(a), businesses may still deduct Cost of Goods Sold (COGS) when calculating taxable income from sales from marijuana products; however COGS does does not include labor or overhead costs incurred during cultivation or delivery processes.

Fortunately, there is help available! Vertices is an experienced partner who can provide valuable insight into navigating these complexities while also helping you find ways to lower your tax liability within applicable regulations. Their team has an in-depth understanding of all applicable laws and regulations governing legal cannabis sales and cultivation throughout the US, so you know you’re getting reliable advice from experts who understand your field.

By partnering with Vertices, you can rest assured knowing that your medical marijuana business’ finances are professionally managed by experienced professionals who will guide you through even the most complex of financial matters related to taxation and accounting while ensuring compliance with all relevant regulations. Contact us today get started!