Did you receive Form OTC-901 in the mail from your County Assessor in Oklahoma? What is it? Should I answer it? For many business owners, receiving any tax forms in the mail can bring up some anxiety. In the case of Oklahoma’s 901 form, many of our clients thought it was not even a legitimate tax form. It is legitimate and it is important to file.

All Oklahoma professionals, partnerships, corporations, and businesses must annually file Form OTC-901, documenting and reporting all taxable assets. The OTC-901 is a Business Personal Property Return for the county where the property is located. Because it is a county tax, it can leave businesses with multiple Oklahoma locations submitting OTC-901s to different county assessors.

NOTE: Not all OTC-901s from the different counties look the same.

Title 68, Section 2832 of the Oklahoma Statutes requires all business personal property to be reported each year to their County Assessor’s Office. If you received it in the mail, then your county has determined that you may have property to report. If you didn’t receive it in the mail, contact your county assessor’s office to get one. Ignoring the form or claiming that you did not receive one can still leave you owing thousands in back taxes, fees, and penalties. All businesses are expected to file OTC-901, even if they have not received one in the mail this year.

Yes, you must file OTC 901 even if you lease assets. The form tracks all taxable property, including leased items, for informational purposes. Report leased assets in the designated section

You only need to report the original cost of the assets on the OTC 901, not the depreciated value. This includes both owned and leased assets.

The assessor’s office will use their own depreciation schedules to determine the assessed value for tax purposes.

No form? File anyway. It’s your responsibility, not the assessor’s. Penalties apply for late filing. Contact your county assessor for a copy or check their website for online filing options.

No, unfortunately you cannot amend a previous year’s OTC-901. According to information from Oklahoma counties, amended returns for OTC-901 are not accepted.

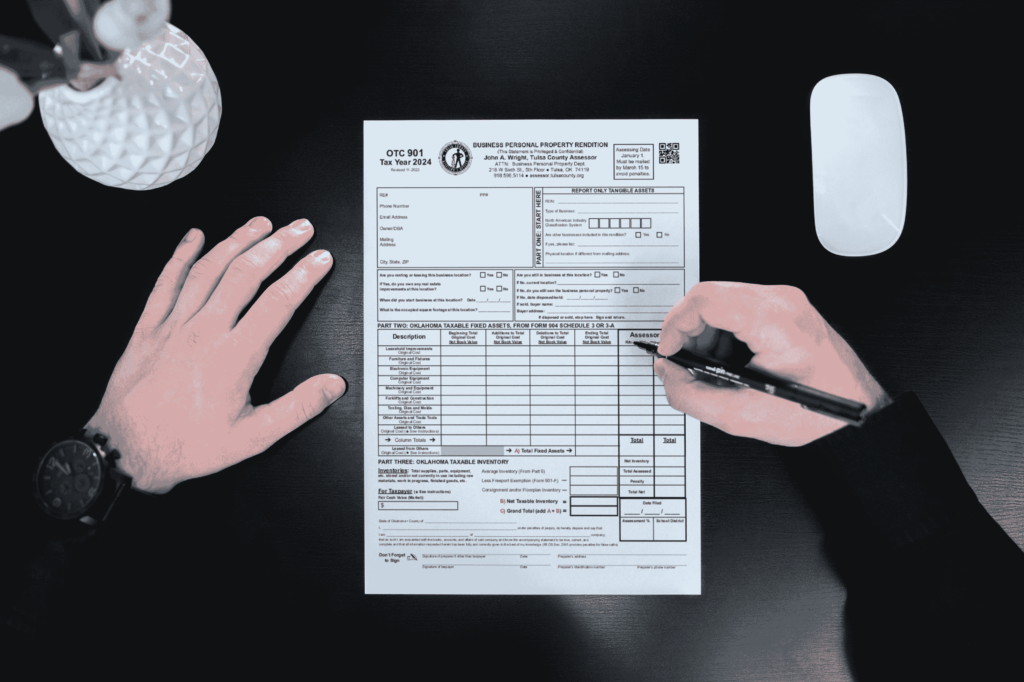

Part 1 – Identifies the business name, address, Federal/State Identification Number, type of business, Standard Industrial Classification (SIC) Code, usable square footage, and the business telephone number.

Part 2 – Businesses filing a OTC 901 for the first time will have to report the taxable fixed assets, listed by year of acquisition. If you have received a form that had beginning totals, those are your ending totals from the OTC-901 you filed in the prior year. In this case, you will be adding or deleting (bought or sold) any assets for the year being filed for. Your ‘Beginning totals’ plus ‘Additions to Total’ minus ‘Deletions to Total’ give you the ‘Ending Total’. The assets are put into categories along the left side of the form. You must report all fixed assets except automobiles, buildings, and/or land. Please note, you can use a OTC-901 Scheduled 3-A if you run out of room.

Part 3 – Inventory: all businesses that carry goods in inventory are required to submit an average inventory amount. Some forms have a location for each month’s inventory and others ask simply for an average. To find an average inventory, add up each month’s beginning inventory then divide by the number of months you reported.

Part 4 – Identifies the taxable fixed assets purchased in the reporting year. The summary part goes to Part 2. Additional forms are available if you need more space.

Part 5 – Identifies the deleted fixed assets for the reporting year. The summary goes to Part 2, Deletions to Total. Additional forms are available if you need more space.

Part 6 – Is used to calculate the average of your Inventory by month. The average will be carried to Part 3.

SIGN! – The rendition must be signed by an owner, partner, officer, or agent under penalty of perjury.

Failure To File or Late Filing – The due date is March 15th (postmarked), and failure to file will subject the business to a mandatory penalty of 10%, or 20% if not filed by April 15th. If a return is not filed, an arbitrary assessment will be prepared by your county using the best information available to them. An arbitrary assessment can be protested within a limited number of days of the date of notice. After that, no amendments or protests are allowed, and those figures stand for that year. We tend to find the assessment done by county assessors to be much greater than the actual assessment should be.

Reminder: Your form may have a different layout than discussed above. These forms are county by county, and although the information being requested is the same, the forms may look quite different.

What if I have no changes to the report from the previous year? You still need to submit the report along with an explanation about why there is nothing to report. But you must file it with your County Assessor’s office.

I sold my business, do I still have to file? If so, you must notify your County Assessor in writing with the business name, date of closing, and the new owner’s name. The owner as of January 1 is the responsible party for filing the return. However, the county still needs to be notified of the change in ownership. If you closed the business and still own the assets, you still must file the return.

What if I have multiple locations in Oklahoma? If you have more than one business in a location, you will need to file an OTC-901 for each business so the school districts get funded correctly.

Do I have to include equipment that I lease from someone else? Yes you do! There is the expectation that you will report in the proper location on your form “leased from others” any property that you lease. It is important to note that most assessors we have spoken with agree that these items are not taxed to you.

I reported something incorrectly, can I amend it? The Assessor’s office sends out notices of assessments showing the value placed on the assets and business. It allows you 20 (some have said 30) days to review and contact the Assessor’s office to correct any mistakes or problems. If you are not satisfied with the corrections made, you can make a formal protest to the County Board of Equalization within 20 days of the notice. You would need to contact your county to find out when they are in session. Different counties may require different recourse to address incorrect items.

The OTC-901 Form I was sent looks different than what you described? Each county is in charge of collecting the 901 tax. We have found that some of the counties forms look rather different than each other (and the main State form we used for reference in this article). Some counties also have recommended different practices or discussed different levels of enforcement. When in doubt, contact your local county assessors office.

If this seems overwhelming, contact us for help in preparing the OTC-901! If you are unsure if your business may be required to file a 901, call your county assessor. Our experience indicates that enforcement of the OTC-901 can vary slightly across counties.

Oklahoma Gov – https://oklahoma.gov/content/dam/ok/en/tax/documents/forms/ad-valorem/current/901.pdf

Stephens County Assessor’s Office – https://scaook.com/business-personal.html